GNRE - Agility in Tax Guide Issuance

An important process that ensures compliance with tax obligations is the control of the

payment of taxes to be collected in states adverse to the company's tax domicile.

Due to the volume of operations generated and the different launch dates, this activity

is under the control and manual consolidations carried out centrally and subject to errors.

With this in mind, FOCUS IT created the GNRE solution to allow control of these payments,

ranging from the creation of the relevant invoices for this type of tax to their settlement

in the SAP ERP finance module. This solution is built on ABAP and operates on the

same platform as SAP ERP.

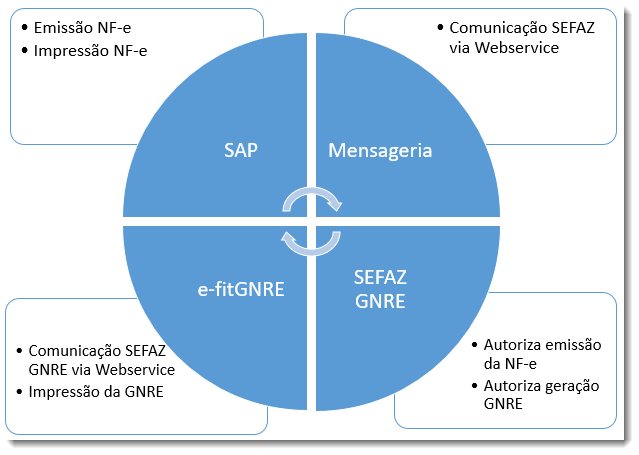

Combined with our FIT OUT messaging solution, it communicates automatically with the competent bodies for issuing the guide requests automatically.

This calculation is demonstrated on a monitor where the user releases requests manually or sets the system to do everything automatically. SAP ERP can also provide a payment approval flow for these tabs, as our solution will integrate these payments with SAP ERP Accounts Payable.

Guide printing is done by the GNRE solution.

Avoid mistakes and late tax payments by integrating them with your financials

automatically.

The GNRE solution allows:

Issue requests for the relevant invoices tabs for these taxes;

The FIT OUT messaging communicates with the relevant agencies and manages the generation of the guides, presenting all the steps of the process in a monitor in SAP ERP;

All tab requests released on the GNRE monitor are integrated with accounts payable and enter the company's cash flow;

Tab payment enters the payment approval flow set up in SAP ERP, following the rules established by the company for the amounts and nature of payments;

When the payables security is settled, the GNRE monitor is updated, allowing a managerial control of all tax bills;

Issue scheduled late payment alerts on the tax tabs monitor.

FOCUS IT has its own know-how to maintain and sustain this tax solution, anticipating the

tax trends and technological developments inherent in these tax obligations.

With the experience gained in the various tax projects and various segments served, we can

help define optimal processes.