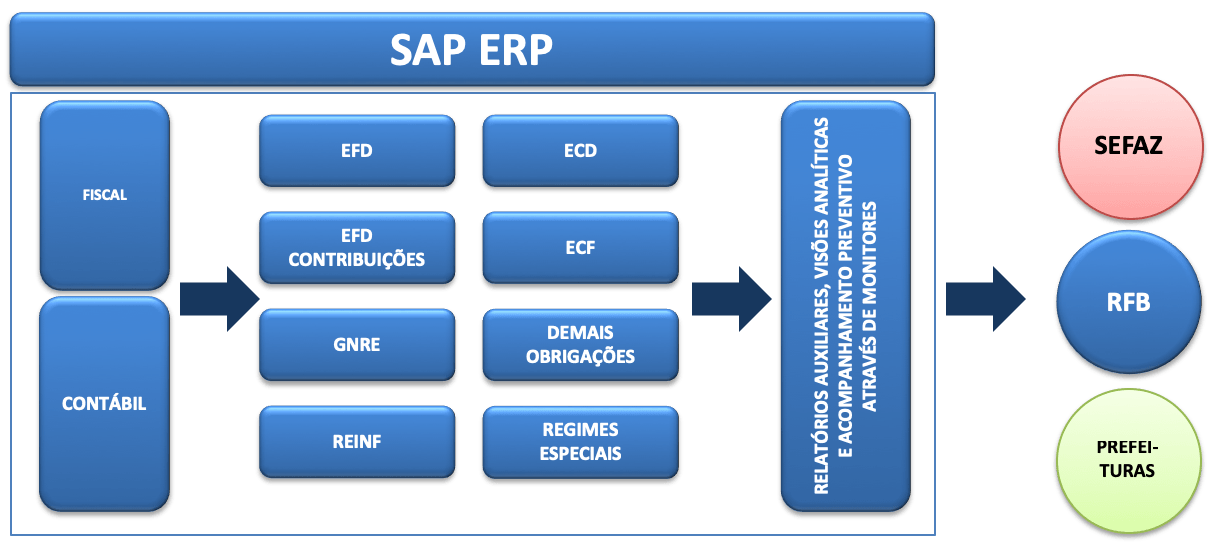

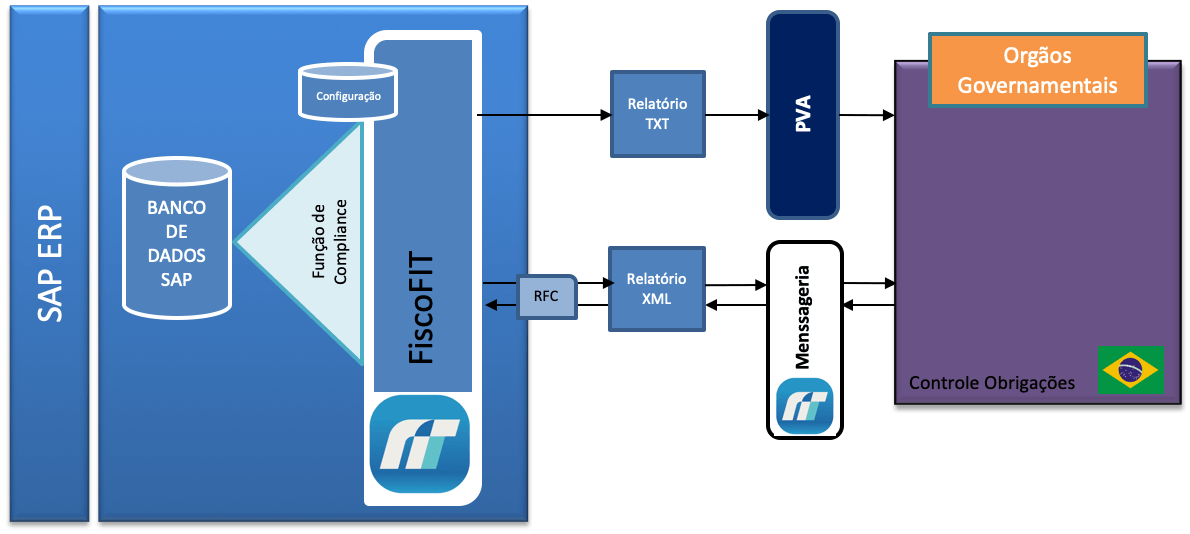

FISCOFIT is now SMART FISCAL, the solution that aims to meet all the tax requirements that companies are required to meet, covering federal, state, municipal and sectoral obligations.

With the attendance of several types of special regimes, the tool is flexible and has

configurations embedded in its menu. However, it is a solution developed with the

same graphical interfaces that SAP ERP users are used to, dispensing with the

training process and avoiding the impact generated by the implementation

of a new tax solution, as well as utilizing the information from the

original base, ensuring the integrity of these.

We offer the most diverse services such as:

- Tax monitors for control and analysis;

- Reconciliation monitors of tax and accounting entries to validate their integrity;

- Alerts for maturity of obligations and monitoring of deliveries;

- Mass update of standardized information;

- Auxiliary and poll reports, including user customization;

- Information displayed in drill down form;

- Extraction of tax obligations, according to the legislation;

- Issuance and control of tax guides.

A solution that can be licensed in a modular way, allowing the company to purchase only the modules of the desired obligations for the initial period of use, as the others can be

incorporated over time. With this, the company pays only for what it

will really use.

Adhering an internal solution to SAP eliminates the maintenance of interfaces by IT staff, ensuring information integrity and enabling the company to quickly and safely meet its tax obligations.

In addition to the obligations that have digital file formats and are transmitted electronically, the solution enables the generation of verification reports to complete the ancillary requirements, highlighting the PIS / COFINS, ICMS, ICMS ST, as well as reports for the compliance with special regimes, CIAP control, FCI calculation and usage control, withholding taxes, income proofs and interfaces that combine accounting and tax integration.

Benefits:

Contains monitors for validation of fiscal and accounting integrity, comparing these entries and indicating divergences;

It has reports and monitors that allow decision making through the analytical statements present in them;

Agility in the generation of obligations without the need for exporting information or reconciling with more than one database;

Anticipation of the tax amounts calculated, viewing the information throughout the legal period and not only at the end;

Absolute integrity between the various obligations delivered by adopting a single repository of information, SAP ERP itself;

Easy support and maintenance of the solution using the same processes currently in use in SAP ERP;

Considerable reduction of errors in tax obligations by adjusting the processes at the source of information;

Elimination of other operating environments such as servers and databases.

We have our own know-how to maintain and sustain this tax solution, anticipating the tax trends and technological developments inherent in these tax obligations. With the experience gained in the various tax projects and various segments served, FOCUS IT can assist in the delivery of

obligations and the definition of optimized processes for

companies' tax area.